Sometimes, you chase clients and spend a lot of effort and money looking to win their business. When your firm finally gets that new client, you want to have a system in place to collect information to onboard them quickly and easily.

That’s where a good client intake form comes in.

This article sheds more light on what a client intake form is, the benefits of having one, and how you can create it for your business.

A client intake form is a data collection form that allows accounting businesses to collect information about their new clients during the onboarding process. Think of it as a questionnaire that helps you better understand your new accounting clients, from their primary business activity and type of entity to their revenues and tax status.

Having a client intake form for new accounting clients is about more than automating and organizing an admin task. It comes with several benefits.

A well-designed client intake form provides you with all the information you need about your new client and their business in one place. That means no more searching through file folders for things like a client’s direct phone number, business structure, or method of accounting. Or even worse, having to make an embarrassing phone call to ask for information you should already know.

We all know the excitement of obtaining a new client and the increase in revenue they bring. But can you retain them? Customer retention is just as important as acquisition. It is less expensive to retain customers than to bring in new ones. According to studies, acquiring a new client will cost you about 5% to 25% more than retaining an existing one.

There is no better way to retain a client than to understand their needs and give them exactly what they are looking for, and more. That can range from tax planning and ensuring their tax returns are in order to providing impeccable bookkeeping services.

The client intake process provides more information and insights about new clients’ accounting status and needs. Now you can identify their specific accounting needs and strategize how to meet them, like meeting tax deadlines, closing periods on time, and ensuring nothing in their accounting process falls through the cracks.

Positive first impressions are not just for first dates. In the business world, the first interaction with your client matters. You want to make a great and lasting impression with clients looking for your accounting services.

A seamless onboarding process for new clients can set the tone for a budding relationship. It shows the high level of organization your firm has. It also shows clients how serious you are about knowing and understanding their business. When the process is user-friendly, it assures your clients that you will not take up much of their precious time.

First, you have to decide how you will create your client intake form. You can build a basic one yourself using Word, Excel, Spreadsheets, or Google Docs. Alternatively, you could use a template found online (like the one you’ll find in the next section of this article).

If you are looking for something more sophisticated for your firm and know your way around programming or have a programmer, you can create one from scratch. It might be time-consuming and expensive. However, it lets you build your preferred functionalities and designs.

The next step is laying it out. For an accounting client, your intake form layout could include sections such as:

Remember that a new client intake form needs to be user-friendly and straight to the point with no filler questions. Sometimes that’s easier said than done. A long and tedious form could lead to a frustrated new client.

On the other hand, a shallow intake form collects too little information, leaving you grasping at straws. You certainly don’t want to spend the rest of your day or week fishing for accounting information you could have gotten on the intake form.

It might be impossible to create a new client intake form for every individual client you onboard. It is even harder to create one from scratch. However, you can customize a template and still manage to gather enough relevant details from all clients. Our free downloadable template allows you to collect accounting clients’ basic and necessary information:

It only makes sense to digitize your client intake process to avoid paper records that can be easily lost. This also makes the onboarding process more seamless for your clients.

There are several tools to use to make the process digital. One option is using a workflow solution like Google Forms or Typeform to collect the data. Another way to digitize the process is by embedding the intake form on your firm’s website and allowing prospective clients to fill it out online.

Finally, an online message box or prefilled instant messages of the intake process can help save clients from unanswered phone calls and emails.

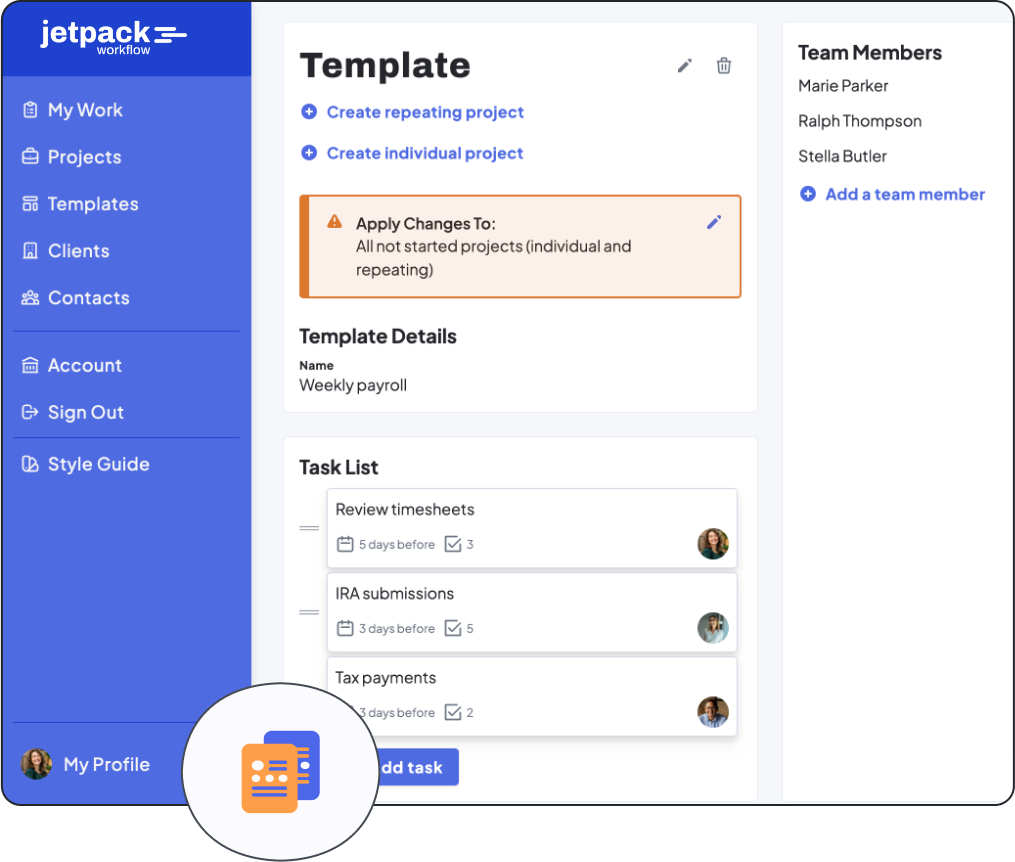

Check out Jetpack Workflow. Our tools help to simplify your accounting firm’s operations by gathering vital client information, delegating work to staff, and keeping track of client deadlines.

With Jetpack Workflow, you can quickly and easily import client information, one-time and recurring projects and tasks, monitor workflows, and much more.

Share this article

Subscribe to the Growing Your Firm weekly newsletter, and get the best accounting workflow templates today!

If you’re part of the 80% of global accounting firms planning to add or expand their advisory services soon, you.

Accounting can be a rewarding career. And especially if you go out on your own and start a firm. Yet.

If you are reading this, then you might be an accountant (or maybe a bookkeeper) looking to start your own.

Get under the hood of Jetpack Workflow’s accounting workflow and project management platform. See some of the top features and how it helps your firm standardize, automate, and track client work more efficiently.

Lessons learned on how top firms grow fast, build stronger teams, and increase profit while working less.

© 2024, Jetpack Workflow.

Ready to find out if workflow software is the right fit for your firm? Select the potential number of users at your company below to get started with your 14-day free trial.

No credit card required to get started.

“Now I have a birds eye view of what’s going on in my firm, so I know what my team is doing, and what’s the status and updates for our clients.”